Motor Insurance; buying it is mandatory in Singapore. Worse still, buying the car insurance and not having a servicing agent to help you during a claim or explain the pros and cons between the different plans or the difference in terminology like "Comprehensive", Third party" and "Third party, Fire & Theft".

I was at AIG Singapore motor insurance counter yesterday on the 7th floor at 78 Shenton Way and had a good 20 minutes eavesdropping to the conversation of a frustrated customer trying to make head and tail of his car insurance bought from AIG Singapore. This was not the 1st time that I've seen disgruntled customers airing their views so that the entire floor knows about their unhappiness but it made me wonder why these clients do not call their agents instead of coming personally to the HQ; then it dawned on me that there were a few probabilities (apart from the customer hotline being too HOT that no one ever picks up the call):

Your Health & Wealth Management Financial Planner, specializing in all your medical insurance and investment needs in Singapore.

TM FlexiCover; An Alternative to TM FlexiAssurance ILP

TM FlexiCover is another ILP or investment linked policy launched by Tokio Marine Group to

TM FlexiCover is another ILP or investment linked policy launched by Tokio Marine Group to remain competitive in the unit linked arena and for clients who prefer ILPs to be a "Front End Load" policy.

To know more about TM FlexiAssurance or ILP, please see our previous post here. So we will not dwell too much about what TM FlexiCover is but list out the features of this plan and you can decide for yourself whether TM FlexiAssurance or this new TM FlexiCover is for you.

Features of TM FlexiCover:

- TM FlexiCover now has unit & premium deducting riders which can be added into the policy. They are : Unit deducting (Critical Illness, Term riders), and Premium paying (waiver of premiums, payer benefit, spouse riders).

- Has LRO (Life Replacement Option), which can benefit companies for using the policy as a Keyman Insurance or for parents who might want to transfer the policy to their new born kids. (please refer to the terms and conditions)

- Dial-up Option which allows the basic sum assured to be reduced to zero to maximise returns, however the life assured has to be 55 years old next birthday and above and premiums must have been paid for at least 10 years' from policy commencement date. (Many other insurers' ILPs require the policy to have some coverage remaining, so this feature benefits the more senior clients when protection charges are rather high)

- Quit Smoking Discount allows smokers to enjoy non smokers monthly protection charges if he/she drops the habit within the 1st two years and can continue after that as long as the cessation is permanent. (take note; if smoker quits only after the 2nd year, then this feature will not apply. The whole reason for this is to encourage and to support the Quit Smoking movement in Singapore.)

- Increase/Decrease in Sum Assured and premiums are allowed, except that reduction of premiums are only permitted after the first 2 years premiums have been made.

- Unlike the TM FlexAssurance, partial withdrawal is allowed at any time as long as the policy is in force and it incurs no charges.

- As with all Investment Linked Policies, premium holiday can be taken after 2 full years of payment. However, do bear in mind that the policy must have sufficient units to maintain the unit deducting riders (if any) and policy values must be enough to finance the premium paying riders, else the policy will just lapse. In reality, please DO NOT take a premium holiday immediately after 2 years as the units and policy value will definitely not be enough to sustain the riders.

Another TM VIP Product From Tokio Marine Group Bites The Dust

"The following measures will be implemented to

all new and pending

TM Infinite VIP applications with immediate effect:

1.

Overall Tranche Limit

An overall tranche limit has been imposed to

this product and this will be

allocated to the respective distribution channels.

This product will be removed from new

business once the respective distribution channels’ tranche limits have been reached, or on

Wednesday, 31 August 2016, whichever is earlier.

2.

Maximum Premium Size for Individual Applications

To allow more customers to still enjoy this product, a maximum single premium of S$500,000 per life assured is imposed. "If you want to know more about the TM Infinite VIP before it is discontinued, check out this post.

You can contact us if you need to know more.

What You Do Not Know About Eldershield in Singapore

Being old and elderly was something far away from my mind, when I started in the insurance

business 20 years ago, but lately, seeing more news articles on retirement and ageing with yours truly also slowly approaching the "Silver Generation", my family and I began to have our antennas up whenever the topic of age related matters popped up.

Lately, a close relative of ours started to have difficulty walking and he was 72. The first thing that came to my mind was Eldershield, as he displayed the criterias needed to submit a claim (for those who are not familiar with the workings of Eldershield, here's a link to read up about it and after reading, you will definitely feel it's insufficient).

However, what confused us was that his premium payments had ended when he was 65, so naturally we thought the cover

business 20 years ago, but lately, seeing more news articles on retirement and ageing with yours truly also slowly approaching the "Silver Generation", my family and I began to have our antennas up whenever the topic of age related matters popped up.

Lately, a close relative of ours started to have difficulty walking and he was 72. The first thing that came to my mind was Eldershield, as he displayed the criterias needed to submit a claim (for those who are not familiar with the workings of Eldershield, here's a link to read up about it and after reading, you will definitely feel it's insufficient).

However, what confused us was that his premium payments had ended when he was 65, so naturally we thought the cover

QBE TravelOn Coverage Changes

Ok, This post came rather late; but as the saying goes, "Better Late Than Never". QBE TravelOn did a revamp to their Travel insurance policy on 02 September 2015 and the rates are rather attractive now with their enhanced benefits as follows:

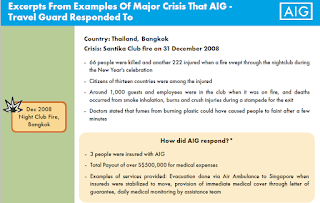

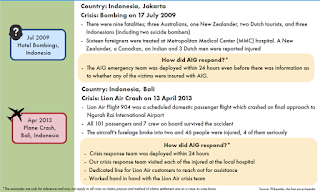

AIG Travelguard Claim Events and Their Response

Of

late, clients were asking us how efficient were the travel claims at

AIG Travelguard? So the best reply we think would be to attach

screenshots of the past claims from AIG and let the pictures speak for

themselves on the responsive actions AIG Travelguard took. There were

recent cases of buses plunging into ravines in Malaysia. Many a times,

it was the trips to our neighboring countries which had travelers

ignoring the call to buy travel insurance since it was only a short journey. However we tend to forget

that there were many winding roads en route to our holiday destinations

and at most times, movement of the vehicles were done

Of

late, clients were asking us how efficient were the travel claims at

AIG Travelguard? So the best reply we think would be to attach

screenshots of the past claims from AIG and let the pictures speak for

themselves on the responsive actions AIG Travelguard took. There were

recent cases of buses plunging into ravines in Malaysia. Many a times,

it was the trips to our neighboring countries which had travelers

ignoring the call to buy travel insurance since it was only a short journey. However we tend to forget

that there were many winding roads en route to our holiday destinations

and at most times, movement of the vehicles were done Retirement Planning With Cash or SRS

With the aging population in Singapore, the buzz word these days is probably Retirement. Tokio Marine Life Insurance Singapore from the Tokio Marine Group will probably be the one insurance company to help you address this need since they have been aggressively launching and promoting new retirement policies of late and here's the latest video just to help you better understand and plan for your retirement using your SRS or cash using one of their latest launch, TM Retirement (SP)! (For those who want to know what is SRS or how it can help you in your tax planning, visit this page)

So if you are someone who wants more money in your twilight years to complement your CPF monies, watch this retirement video and start calling us to find out more! [From 1 Jan 2016, please leave your CONTACT NUMBER in the "message" box, so we can verify that your interest is real and not for the sake of getting quotations only. (For quotes, you can call the insurers directly). Thanks for your understanding]

So if you are someone who wants more money in your twilight years to complement your CPF monies, watch this retirement video and start calling us to find out more! [From 1 Jan 2016, please leave your CONTACT NUMBER in the "message" box, so we can verify that your interest is real and not for the sake of getting quotations only. (For quotes, you can call the insurers directly). Thanks for your understanding]

Subscribe to:

Posts (Atom)