Your Health & Wealth Management Financial Planner, specializing in all your medical insurance and investment needs in Singapore.

Showing posts with label Travel Insurance. Show all posts

Showing posts with label Travel Insurance. Show all posts

QBE TravelOn Coverage Changes

Ok, This post came rather late; but as the saying goes, "Better Late Than Never". QBE TravelOn did a revamp to their Travel insurance policy on 02 September 2015 and the rates are rather attractive now with their enhanced benefits as follows:

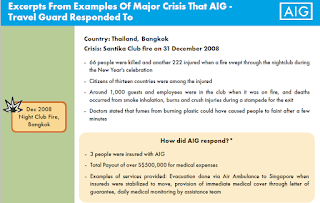

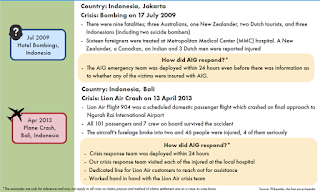

AIG Travelguard Claim Events and Their Response

Of

late, clients were asking us how efficient were the travel claims at

AIG Travelguard? So the best reply we think would be to attach

screenshots of the past claims from AIG and let the pictures speak for

themselves on the responsive actions AIG Travelguard took. There were

recent cases of buses plunging into ravines in Malaysia. Many a times,

it was the trips to our neighboring countries which had travelers

ignoring the call to buy travel insurance since it was only a short journey. However we tend to forget

that there were many winding roads en route to our holiday destinations

and at most times, movement of the vehicles were done

Of

late, clients were asking us how efficient were the travel claims at

AIG Travelguard? So the best reply we think would be to attach

screenshots of the past claims from AIG and let the pictures speak for

themselves on the responsive actions AIG Travelguard took. There were

recent cases of buses plunging into ravines in Malaysia. Many a times,

it was the trips to our neighboring countries which had travelers

ignoring the call to buy travel insurance since it was only a short journey. However we tend to forget

that there were many winding roads en route to our holiday destinations

and at most times, movement of the vehicles were done Grouplus - Another Great Group Annual Travel Policy From AIG Singapore

Remember we shared on the benefits of AIG Travelguard in a post last year? In case you missed the write up, here are the reasons why you want to get your travel insurance from AIG again.

All that you have read are the features and benefits for an individual travel plan. Now, what about a policy for Companies that want a group annual travel insurance for their staff? Once again, AIG wins hands down with their Annual travel policy: Grouplus..simply because of the following Unique features:

SO what are you waiting for? Contact us now to find out more on how Grouplus can benefit your company!!

*New updated post here

All that you have read are the features and benefits for an individual travel plan. Now, what about a policy for Companies that want a group annual travel insurance for their staff? Once again, AIG wins hands down with their Annual travel policy: Grouplus..simply because of the following Unique features:

- Covers Pre-existing conditions (most travel insurance do not cover)

- No Age Limit

- Covers Spouse and kids on business trips

- Covers Leisure trip (for senior management)

- Can be activated as an unnamed policy (Min 5 pax to commence)

SO what are you waiting for? Contact us now to find out more on how Grouplus can benefit your company!!

*New updated post here

Is AIG TravelGuard Travel Insurance Too Expensive or Diamond in the backyard?

When it comes to travel insurance, many of my clients who often buy such a travel insurance policy before they travel, often say that AIG TravelGuard is expensive; to which in the past I do agree until I began to see the beauty of their benefits of late.

Here's a disclaimer before I share them: some of the features are actual cases I experienced, which might not be spelt out completely on the brochure, to prevent abuse by the public and others are actual benefits shared with us advisers by the travel claims and marketing staff from AIG.

When it comes to travel insurance, many of my clients who often buy such a travel insurance policy before they travel, often say that AIG TravelGuard is expensive; to which in the past I do agree until I began to see the beauty of their benefits of late.

Here's a disclaimer before I share them: some of the features are actual cases I experienced, which might not be spelt out completely on the brochure, to prevent abuse by the public and others are actual benefits shared with us advisers by the travel claims and marketing staff from AIG.Here're some of the reasons you might want to re-consider your travel insurance plans for the coming holidays:

- AIG has the Most number of travel branch offices in the WORLD, making accessibility to you in event of claims easier (a few examples were some recent claims that involved massive number of people in bus/car accidents, AIG Travelguard was always the 1st to arrive to the scene)

- AIG Travelguard has their own airplanes, once again always being the first to respond in a crisis (to the extent, other insurers often request assistance from them; which AIG provides, but not after evacuating their clients first).

- One of a few insurers (I believe only 2 companies) allowed to sell their policy at NATAS fair, just shows you the level of confidence the Singapore Travel Association has in them.

- Insured bought travel insurance on 13th Sep and due to depart on 15th Sep, but there was major earthquake on 14th Sep in his planned destination, so he has to cancel trip. Verdict ~ Claimable (Some insurers insist that you need to buy 7 days or earlier before departure for coverage to commence).

- Insured contracted flu virus on the 2nd last day of trip in Japan. Finds it cumbersome to visit a doctor in Japan & intends to visit his family doctor back in Singapore when he returns. Verdict ~ Claimable as long as he sees the doctor within 2 days upon return. (Many insurers are removing this benefit, as it was largely abused in the past when insurers gave clients up to a week upon return to claim).

In any case, if you are still interested, you can contact us here !

Subscribe to:

Comments (Atom)