Even though they do have a lock in period with penalty charges, how many of us actually bothers with the puny interest which the fixed deposits pay out and when crisis comes a calling, we simply just move the funds to where it's needed most or for some of us, move it into a better interest yielding vehicle.

You can see how pathetic the FD rates in Singapore here (Click on image for clearer view):

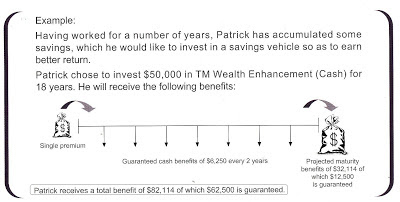

The good and bad of TM Wealth Enhancement or what some of us might call TM-ENrich:

(Click on image for clearer view)

- Minimum investment is $25,000 (only cash, no CPF funds are allowed)

- 5 years plan. (The whole idea is that you should not have easy access, else your nest-egg will never be built!)

- Pays a death benefit of 125% of your capital, in event of a misfortune. (Banks' fixed Deposits will only pay you back your capital invested)

- On the 5th year or maturity year, the guaranteed interest of your capital is already 4.6% ($459/$10000). Based on a $10K example (see above).

- Every year, once Tokio Marine declares the bonuses to you, that declared bonus, will then become part of your guaranteed bonuses. (contact us for the details if that statement was mind boggling!)

- Tokio Marine is one of the only insurer which has not cut their bonus projection for many years and is the only company which is still projecting and delivering positive guaranteed yields. (ie unlike some firms, which seem to give higher rate of returns, but they place their high yield projections on the non guaranteed element).