The Tokio Marine Group in Singapore has added another retirement product into its already

comprehensive range! This time the newly launched, TM Retirement Secure was introduced to Singapore on 08 January 2016 and is particularly suited for individuals looking for guaranteed income for a fixed span of time; whilst having a short premium commitment period!

One can even add a Cancer Income Rider (details in upcoming post) or a Cancer Waiver Rider! Just to make sure that your retirement plans will not be hampered should an unforeseen event like Cancer is to strike and you need your lifestyle to continue as before.

Some of the features of TM Retirement Secure that is worth highlighting are as follows:

Your Health & Wealth Management Financial Planner, specializing in all your medical insurance and investment needs in Singapore.

Showing posts with label Guaranteed. Show all posts

Showing posts with label Guaranteed. Show all posts

Wealth Accumulation

Wealth Accumulation seems to be the buzz word these days when the

entire financial world is so full of uncertainty. However, with so many

options demanding for our already stretched dollar, which plan is the

right one?

Here's a great plan for those who are rather risk adverse :

Tokio Marine's TM Nest Egg (Limited Payment)

Features

Benefits of this Wealth Accumulation plan

If you want to find out more, feel free to contact us now!

Here's a great plan for those who are rather risk adverse :

Tokio Marine's TM Nest Egg (Limited Payment)

Features

- TM Nest Egg is an Endowment plan and is for anyone between ages 1 to 60

- Financial Protection in event of Death & Total & Permanent Disability

- Policy terms from 10-30 years (in multiples of 5)

- Limited Premium Payment terms from 5 - 25 years (also in multiples of 5)

- Option to receive maturity proceeds in lump sum or yearly payment between 3 and 25 years.

- Min Sum Assured S$30,000

- Has Child Maturity Option, which allows the child to purchase a new Whole Life or Endowment policy without further medical evidence.

Benefits of this Wealth Accumulation plan

- Maturity Benefits if it's taken in instalments, the remaining balance left with the company still earns interest, which is definitely much better than Fixed Deposits rates in Singapore; what it means to you is that it helps you control your savings too and not squander it on some impulse purchases if the proceeds were to be taken in a lump sum instead.

- When compared to their closest rival, Tokio Marine's TM Nest Egg (LP) is a limited payment plan as compared to their competitor, which is a regular payment plan. (Wouldn't a limited liability be better for your wealth accumulation planning since it helps you forecast your expenditure in a more foreseeable future?)

- Tokio Marine's TM Nest Egg (LP) has POSITIVE guaranteed yields as compared to their competitor's negative yields throughout their policy term. (Can you remember reading in the news about certain insurers cutting bonus rates over the recent years? These same insurers gave high projections when policies were sold initially-A high percentage of those projections were Non-Guaranteed!)

- If you are buying Tokio Marine's TM Nest Egg (LP) policy for your children, the insurer is currently the only company in Singapore (as of August 2011), which allows "waiver of premiums" rider to be bought on both parents lives, so that whatever happens to either parent, your gift to your child is still secured. (Other firms only has this rider available to the payer)

If you want to find out more, feel free to contact us now!

Fixed Deposits - Love them or simply hate them!

Love them because they provide you with liquidity and that's the same reason why you hate them: it can't help you with any wealth enhancement simply because it's so accessible!

Even though they do have a lock in period with penalty charges, how many of us actually bothers with the puny interest which the fixed deposits pay out and when crisis comes a calling, we simply just move the funds to where it's needed most or for some of us, move it into a better interest yielding vehicle.

By

now I believe you can see that they don't really help in hedging

against inflation in Singapore. However, there are still some of us who

just sleep better to know that cash is available and accessible. Well to

these people, here's something from Tokio Marine Life Insurance which

you might find of some interest as a replacement to the usual Fixed or

timed Deposits.

The good and bad of TM Wealth Enhancement or what some of us might call TM-ENrich:

(Click on image for clearer view)

Even though they do have a lock in period with penalty charges, how many of us actually bothers with the puny interest which the fixed deposits pay out and when crisis comes a calling, we simply just move the funds to where it's needed most or for some of us, move it into a better interest yielding vehicle.

You can see how pathetic the FD rates in Singapore here (Click on image for clearer view):

The good and bad of TM Wealth Enhancement or what some of us might call TM-ENrich:

(Click on image for clearer view)

- Minimum investment is $25,000 (only cash, no CPF funds are allowed)

- 5 years plan. (The whole idea is that you should not have easy access, else your nest-egg will never be built!)

- Pays a death benefit of 125% of your capital, in event of a misfortune. (Banks' fixed Deposits will only pay you back your capital invested)

- On the 5th year or maturity year, the guaranteed interest of your capital is already 4.6% ($459/$10000). Based on a $10K example (see above).

- Every year, once Tokio Marine declares the bonuses to you, that declared bonus, will then become part of your guaranteed bonuses. (contact us for the details if that statement was mind boggling!)

- Tokio Marine is one of the only insurer which has not cut their bonus projection for many years and is the only company which is still projecting and delivering positive guaranteed yields. (ie unlike some firms, which seem to give higher rate of returns, but they place their high yield projections on the non guaranteed element).

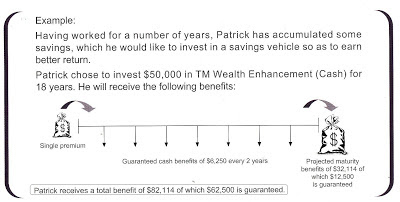

TM Wealth Enhancement (Cash)

Do not let the headline mislead you. This plan DOES NOT

require you to finance in cash only. TM Wealth Enhancement (Cash) is

basically the official name of the policy which is a single premium plan

that pays you cash benefit of 10% of the Sum Assured every 2 years!

Do not let the headline mislead you. This plan DOES NOT

require you to finance in cash only. TM Wealth Enhancement (Cash) is

basically the official name of the policy which is a single premium plan

that pays you cash benefit of 10% of the Sum Assured every 2 years!For Cash paying clients, treat yourself to a vacation or spend it on your loved ones. For CPF investors, it is still a great plan to maximize your retirement nest egg through this option! You also have the option of re-investing the cash benefits with Tokio Marine at an attractive interest rate. Whichever option you choose, you reap all the benefits!

Flexibility to Choose

TM wealth enhancement (Cash) allows you to purchase using cash or funds from your CPF-OA or SRS accounts. The plan offers policy terms from 13 to 21 years and it's a great program for meeting different milestones in your life.

As you can see from the illustration below, the total maturity proceeds from the cash benefits and maturity payouts are easily at least 75% guaranteed!

For some of you who feel that to wait a minimum of 13-14 years is pretty long for the policy, be comforted to know that the policy pays out GUARANTEED cash benefits to you every 2 years, thus in actual fact you are already having your money returned progressively to you from the second year onwards! You can even use the cash benefits payout to fund another smaller premium policy on an annual mode!

However, if you still feel more secured with having a policy with a shorter period, then you can also consider Tokio Marine Life Insurance Singapore's 5 year plan, TM Enrich. (However, this policy has to be financed by cash only)

Guaranteed Protection

With TM Wealth Enhancement (cash), should any unforeseen events happen to you (Death or TPD), it will pay the full sum assured plus any attaching bonuses over and above the cash benefits you may have already received. (TPD coverage is until the policy anniversary preceding age 65).

If you want to know more about this plan, feel free to contact us.

Subscribe to:

Comments (Atom)