When I first read it, I thought it was actually some sort of death benefit like in most company insurances, whereby the insurer pays out a lump sum out of sympathy or goodwill to the deceased's family for the purpose of helping them in the completion of the final rites etc.

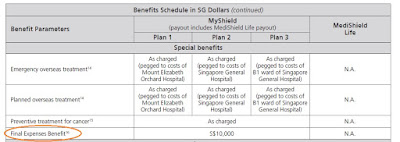

However, when my own relative passed on recently, then did I realised that this Final Expense was just a feature to waive the deductible or co-insurance, if one did not buy the cash riders. Here are the screenshots of 2 of Singapore's top insurers' table of benefits and definitions of the feature (click on image to enlarge):

|

| Aviva Myshield Table of Benefit |

|

| Aviva Myshield definition of Final Expense |

|

| NTUC Enhanced Incomeshield Table of Benefits |

| ||||||||||||

| NTUC Enhanced Incomeshield Definition of Final Expense |

So this post is to manage your expectation and to highlight that the Final Expense in the Integrated Shield Plans are not death benefit payouts, but more for taking care of the co-insurance and deductibles if death were to occur in hospitals or 30 days after leaving the hospitals and when the insured did not buy a rider.

Do note that Final Expense benefit is not available to Medishield Life plans. Feel free to contact us if you need more information

No comments:

Post a Comment